Investing in a solar energy system or battery storage can significantly reduce electricity bills and help the environment. However, the initial costs can be a hurdle for many. The good news is that there are several payment and finance options available to make solar systems and battery purchases more accessible. In this article, we’ll explore different financing and payment options that can help you make the switch to solar without straining your budget.

1. Upfront Purchase

The most straightforward option is to pay for your solar system or battery upfront. This option provides the highest financial return in the long run. When you buy the system outright, you own the equipment from day one. You can take full advantage of government incentives, feed-in tariffs, and enjoy the energy savings immediately. Additionally, you avoid paying interest or finance fees.

However, paying upfront can require a significant cash investment. For residential solar systems in Australia, the cost typically ranges between $3,000 and $10,000, depending on the system size. Battery storage can add an additional $5,000 to $12,000 to the total cost. If you have the funds, this can be the most cost-effective option in the long term.

2. Green Loans

If paying upfront isn’t feasible, many Australian banks and lenders offer green loans. These loans are specifically designed for environmentally friendly purchases, including solar systems and batteries. Green loans usually have lower interest rates than traditional personal loans, making them an attractive option.

Lenders often offer flexible repayment terms, which can be tailored to your financial situation. Loan terms typically range from 1 to 7 years. Some banks even allow early repayments without penalties, reducing the total amount of interest paid. By financing your system with a green loan, you can spread the cost over time while still benefiting from lower energy bills.

3. Interest-Free Payment Plans

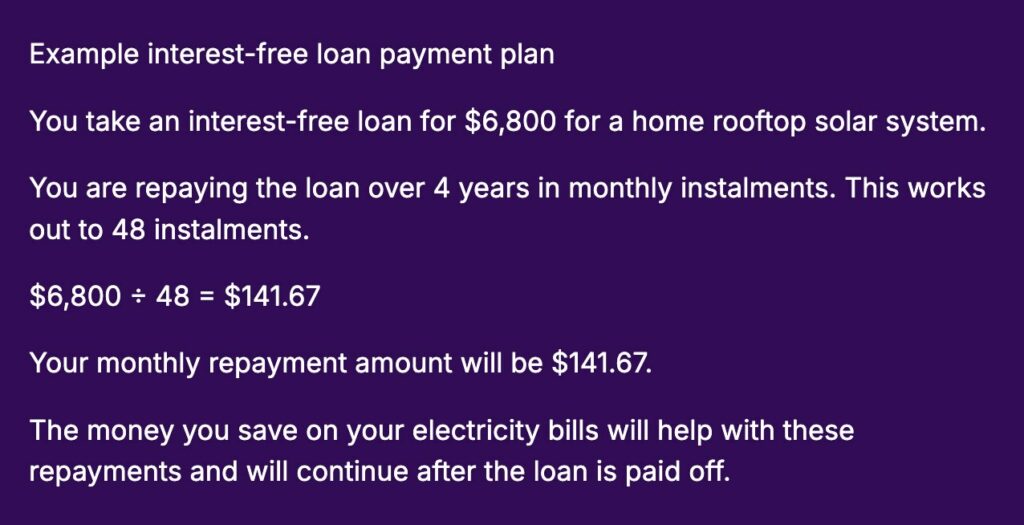

Many solar installers and battery providers offer interest-free payment plans. These plans allow you to spread the cost of your system over several months or years without paying any interest. This can be a great option if you want to avoid the upfront cost but don’t want to take out a loan.

With an interest-free payment plan, you’ll typically make regular monthly payments for a set period, which can range from 12 months to 60 months, depending on the provider. As long as you make the payments on time, you’ll pay no additional fees or interest. This is a popular option because it allows you to start saving on energy costs immediately while paying off the system over time.

4. Solar Power Purchase Agreements (PPA)

A Solar Power Purchase Agreement (PPA) is a contract between you and a solar provider. With a PPA, the provider installs the solar system on your property at no upfront cost. You then agree to buy the electricity generated by the system at a rate usually lower than your current utility rate.

This option allows you to enjoy immediate savings on your electricity bill without having to purchase the system. The solar provider owns and maintains the system, so you don’t have to worry about ongoing maintenance costs. However, you won’t own the system, and your savings might be lower compared to owning a system outright. Most PPAs have a contract period of 10 to 25 years.

5. Solar Leasing

Similar to a PPA, solar leasing allows you to install a solar system on your property with no upfront cost. However, instead of paying for the electricity generated, you pay a fixed monthly lease payment. The lease payment is typically lower than your current electricity bill, leading to immediate savings.

One key difference between a lease and a PPA is that with a lease, your payments remain the same, regardless of how much electricity the system generates. This can be a benefit if electricity prices rise, but it also means you might not benefit as much from particularly sunny months. Like a PPA, you won’t own the system, and you’ll need to negotiate terms at the end of the lease period, which usually lasts between 10 and 20 years.

6. Government Rebates and Incentives

In Australia, the government offers several rebates and incentives to reduce the cost of solar systems and batteries. The Small-scale Renewable Energy Scheme (SRES) is one of the most well-known. Under this scheme, homeowners can receive Small-scale Technology Certificates (STCs) that lower the upfront cost of a solar system. The number of STCs you receive depends on the size of the system and your location.

Some states also offer additional incentives. For example, the Victorian Solar Homes Program provides rebates of up to $1,400 for solar panel installations, and some states offer rebates for battery storage as well. These incentives can significantly reduce the cost of installing a solar system or battery, making it more affordable.

7. Home Equity Loans

If you own your home and have built up equity, you may be able to take out a home equity loan to finance your solar system or battery. Home equity loans generally have lower interest rates than personal loans because your property secures them. This can make them an attractive option for financing a solar system.

With a home equity loan, you borrow against the equity in your home and repay the loan over a set term. This allows you to spread the cost of the solar system over several years while benefiting from lower electricity bills. However, because your home secures the loan, it’s important to ensure you can meet the repayments to avoid risking your property.

8. Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) services like Afterpay and Zip Pay have become popular financing options for many types of purchases, including solar systems and batteries. These services allow you to spread the cost of your purchase over several instalments, often with no interest or fees if paid within a certain timeframe.

BNPL services typically offer shorter repayment terms, ranging from a few weeks to a few months. This can be a great option if you need a short-term financing solution and can commit to making the payments on time.

Conclusion

There are many ways to finance a solar system or battery, each with its own advantages. Whether you choose to pay upfront, take out a loan, or explore leasing options, the important thing is that solar energy is more accessible than ever. With the right financing option, you can start saving on your electricity bills while contributing to a cleaner environment. Evaluate your financial situation and energy needs to choose the option that works best for you.