Last update January 9th, 2025 at 09:44 am

Installing a solar panel system can benefit both your home budget and the environment. As a matter of fact, you can expect to save thousands of dollars on the upfront installation of a solar system thanks to the Australian government solar rebate.

However, a solar panel system is associated with a relatively high initial cost. The good news? You only have to pay for a part of it, thanks to the Australian government solar rebate.

The cost is still significant for most households, but remember that the payback period is usually four years. This means that the system in the long run can pay for itself.

So, what exactly is the Australian government solar rebate?

What Is The Solar Rebate?

The Australian government solar rebate offers incentives to both small businesses and households that invest in small-scale energy systems based on renewable energy sources. This includes both hydro, wind and solar systems, and also some hot water systems and heat pumps.

The financial support was initiated to make it more affordable for businesses and people to invest in renewable energy systems that will benefit the environment. This forms the basis of the Australian government solar rebate scheme.

How Does The Solar Rebate Work?

When installing one of the eligible energy systems, you will get small-scale technology certificates (STC). Each STC has a value, and you can receive your rebate by assigning them to the system installer who will give you a discount at the time of installation.

You may also sell your STCs on the open market, or through the STC Clearing House. The latter will give you a fixed price. If you sell the certificates on the open market, the price is set by market forces. Most households opt to take a point-of-sale discount from the solar installer rather than try to navigate the STC Clearing House.

The number of STCs received will vary based on different factors. In general, one MegaWatt-hour or MWh will give you one STC. When calculating how many STCs you will get, you have to consider how many MWh your energy system will produce until the year 2030. The STCs are calculated up front and the amount of STCs you are eligible for is usually determined by your location in Australia, and how big a solar system you are installing. We have developed an STC Calculator as a guide.

The Solar Rebate Decreases Every Year and Will End in 2030

The government solar panel rebate given by the Australian government is scheduled to last until 2030. Every year, the rebate is gradually reduced by around 4 to 5%.

In other words, if you are planning on getting a solar panel system installed, it might be a good idea not to postpone your plans for too long.

The Solar Rebate in 2025

In 2025, the Australian government solar rebate is calculated to pay, for example, around $2,800 for an eligible 9 kW solar system installed in Sydney. Remember that the rebate will not be the same in 2026, 2027 and so on, as it is reduced every year.

The exact rebate will not necessarily be $2,800, even if you install the solar panel system in 2025. Several factors will affect the rebate, including the effectiveness of your energy system. Remember, the more MWh the system is expected to produce, the more STCs you will get. Check out our calculator to help work out your government solar rebate.

The Location Of Your Home Will Also Affect The Rebate

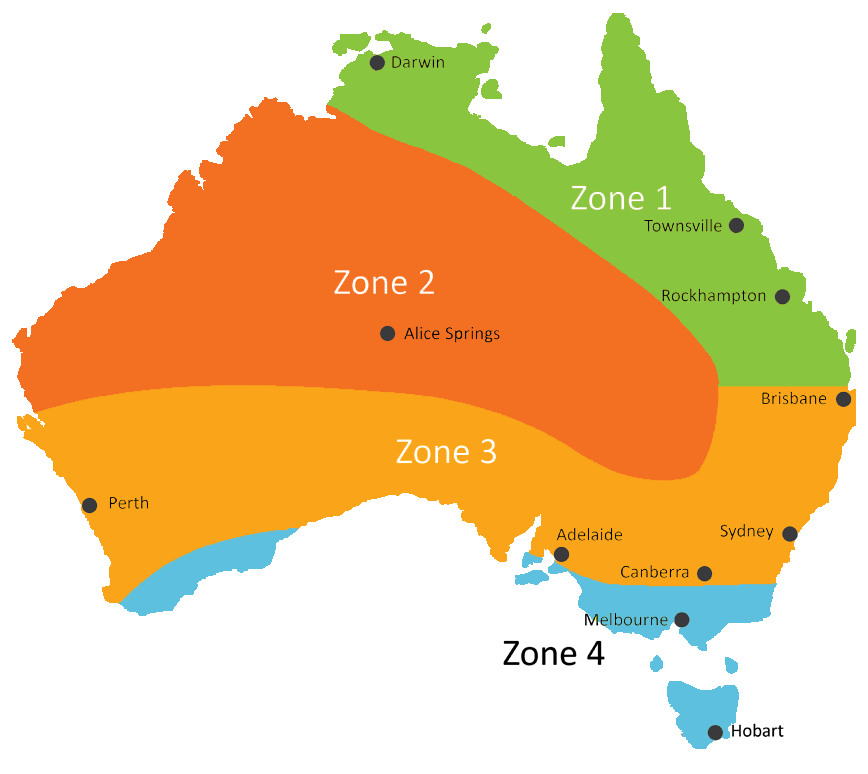

In Australia, the government solar rebate might differ from area to area. You will receive a specific number of STCs based on which STC zone you belong to. Here are the different STC rebates for a regular 6.6kW system across Australia:

- North East Australia: STC zone 1

- Darwin: STC zone 1

- Central and North West Australia: STC zone 2

- Alice Springs: STC zone 2

- Canberra: STC zone 3

- Sydney: STC zone 3

- Brisbane: STC zone 3

- Perth: STC zone 3

- Adelaide: STC zone 3

- Tasmania: STC zone 4

- Melbourne: STC zone 4

| State | Zone | Qty STCs | Rebate |

| SA | 3 | 54 | $2,052 |

| NSW | 3 | 54 | $2,052 |

| VIC | 4 | 46 | $1,748 |

| TAS | 4 | 46 | $1,748 |

| ACT | 3 | 54 | $2,052 |

| NT | 2 | 60 | $2,280 |

| NT | 1 | 64 | $2,432 |

| QLD | 3 | 54 | $2,052 |

| WA | 3 | 54 | $2,052 |

Because of the natural differences in climate, households in different STC zones will not have the same expected annual MWh generation.

In zone 1, the annual generation will likely be around 10 MWh. In zone 4, the annual generation is expected to be no more than 7.5 MWh.

So, if you are living in North East Australia, you will receive a bigger rebate than someone living in Hobart.

What Other Systems Are Eligible For The Rebate?

The Australian government solar rebate is covering installations of solar photovoltaic panels, also known as PV panels. But remember, you might also receive government rebates for other small-scale energy systems that are based on renewable energy sources.

Because of this, you will also receive STCs for installing the following energy systems in your home as long as you use a CEC-approved installer:

- Hydro systems

- Air source heat pumps

- Wind turbines

- Solar water heaters

Get Your Government Solar Rebate Sooner Rather Than Later

Do you want to be able to produce your own electricity? Then a solar panel system is a good idea. The Australian government will give financial support to small businesses and private households that install a solar panel system, which will make it more affordable.

It might be a good idea to install the system as soon as possible. If you wait too long, the rebate will decrease! Make sure you use a CEC-accredited installer for obtaining quotes.